ICYMI: un·cer·tain·ty (ənˈsərtntē), n.

The Fed held steady and market optimism grew but tech lagged as investors weighed slowing growth, trade uncertainty, and potential rate cuts. Bonds and international stocks outperformed (again).

Financial Highlights

Fed Stays Put as Markets Seek Direction

The Federal Reserve held interest rates steady at 4.25%–4.5% for the second consecutive meeting, opting for patience amid economic uncertainty. While inflation remains above target, with core PCE projected at 2.7% for 2025, the Fed also lowered its GDP growth forecast to 1.7%. Many analysts are plainly calling this recognition of the ‘stag’ and the ‘flation’ we’ve been worried about. Despite these concerns, investors welcomed the Fed’s slower balance sheet runoff, which should help support bond markets. U.S. stocks, meanwhile, showed mixed performance. Tech lagged again while value stocks and international equities outperformed, driven by Europe’s infrastructure spending and China’s anticipated stimulus.

Economic indicators painted a murky picture. Retail sales disappointed, rising just 0.2% in February, while consumer sentiment remained suspiciously weak. However, the labor market stayed resilient, with jobless claims meetings expectations and wage gains still outpacing inflation. Manufacturing showed surprising strength, with industrial production rising 0.7% in part due to businesses stocking up ahead of potential tariffs. Housing data was another bright spot, as home sales and new housing starts both exceeded expectations. Treasury yields declined following the Fed’s meeting, boosting bond prices and providing a safe haven for investors navigating market volatility.

What This Means for Investors

With the Fed staying cautious and economic data sending mixed signals, investors should take a note from the Fed and do little. Action for the sake of action will be a mistake. Defensive sectors, bonds, and international stocks continue to provide balance, while volatility may create buying opportunities in undervalued areas of the market as we approach the April 2nd deadline for tariffs.

Market Activity

Stocks and fixed income both caught a bid this week as investors felt renewed confidence in the market ahead of and following the FOMC meeting.

Stocks

Fixed Income

Economic Reports

Retail sales are under a microscope but we need more data before we begin any freaking out. Fed struck a cautious (but moderating) tone. Thursday’s releases validated the Fed and others for not taking any drastic actions. Results came in above expectations.

This Week

Next Week

Earnings Releases

This Week

Next Week

Recommendations

FOMC Meeting | Day-of Coverage & Impact Analysis

Understanding the FOMC Report | Start here to understand the importance of this meeting and the report issued by the Fed.

Fed leaves rates unchanged and maintains outlook for two rate cuts this year | Quick and dirty breakdown of the Fed’s economic projection changes and the impact on rates from Wednesday’s event

Citing Tariffs and Uncertainty, Fed Sees Higher Inflation and Lower Growth | NYT live coverage and analysis on rates, dot-plot, and macro cross-currents.

Bankrate | Day-of coverage and analysis of the FOMC meeting.

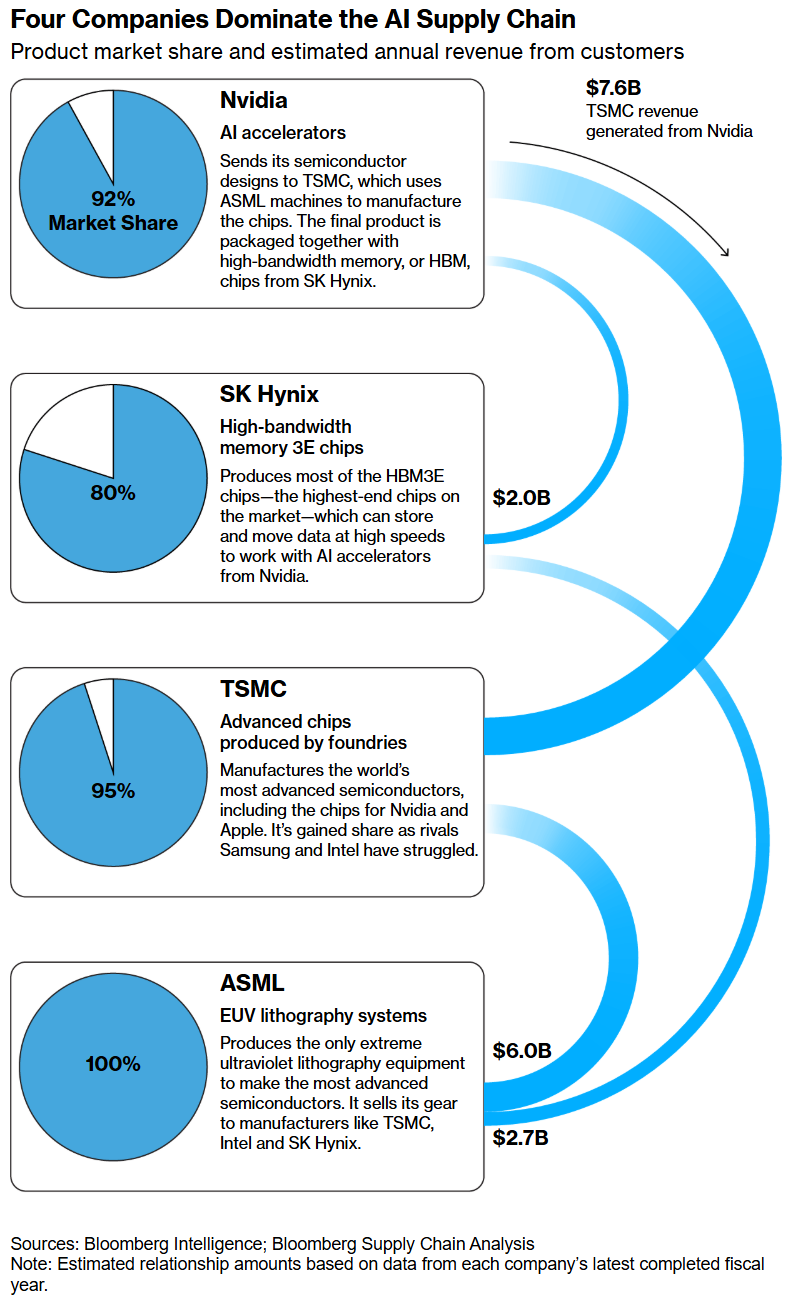

Monopoly Money

How the AI Boom Created the Most Valuable Monopolies in History | Since ChatGPT arrived, Nvidia and its key manufacturing partners have dominated the market for AI chips. Will it last?

Chart(s) of the Week

Consumer sentiment is abysmal. And worsening. Puzzlingly so. By many measures, these sentiment readings are on par with and in some cases worse (!) than during COVID and the Great Financial Crisis. This is either predictive of something bad, or its wildly overreacting. Concern and caution is prudent, panic is not.

This doesn’t seem right. Not because the measurements are flawed, but because the respondents are not responding rationally. Many economists puzzled over the bad vibes in 2023 and 2024. Now, it’s true that fundamentals have credibly worsened, but the vibes are apocalyptic. 🤔

I am very dubious given the current hard data available. Could things worsen? YES. But until they do this is too much.

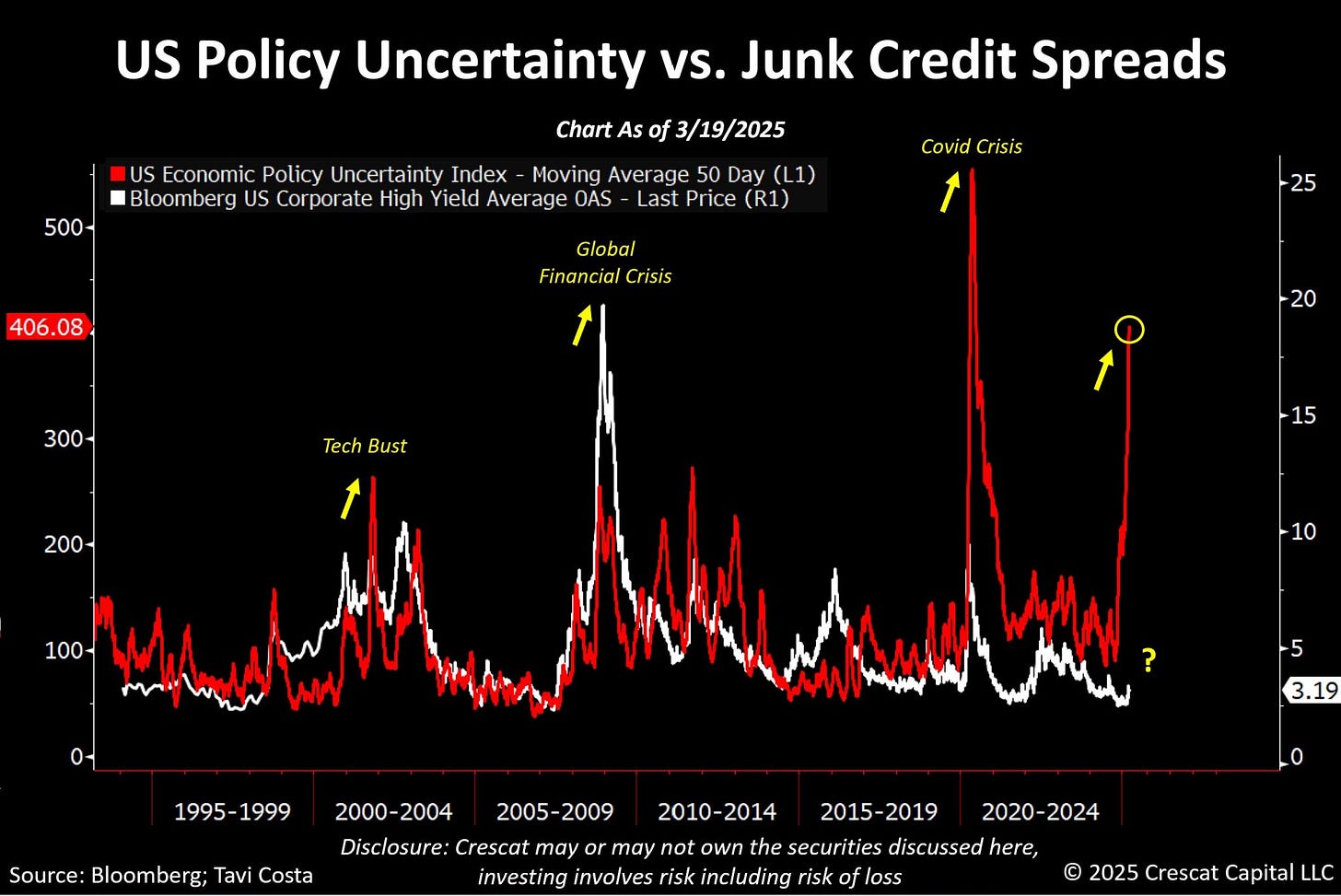

High Yield Spreads

One more: The Uncertainty Index is heading the moon. This chart compares the UI vs high yield spreads. If we were entering the end of days like sentiment reflects, we should expect spread to be blown out and leading like it did in the Dot Com Bubble and the Great Financial Crisis. Is the bond market late? Or unconcerned?

Everyone is certainly uncertain so the index isn’t lying. But its strange to see spread shrugging.

Thanks for reading — Stephen